As cryptocurrencies continue to gain popularity, many people are exploring different ways to invest in them. One option is margin trading, which allows traders to borrow funds to increase their buying power and potentially generate larger profits. In this guide, we’ll cover the basics of BTC/USDT and Ethereum margin trading, including how to get started, common strategies, and risk management.

What is Margin Trading?

Margin trading is a form of trading where traders can borrow funds from a broker or exchange to increase their buying power. In cryptocurrency trading, margin trading involves borrowing cryptocurrencies like BTC/USDT or Ethereum to make trades. The borrowed funds are secured by the trader’s margin account, which is collateralized by the trader’s assets. Margin trading can amplify gains and losses, making it a high-risk, high-reward strategy.

Getting Started with Margin Trading

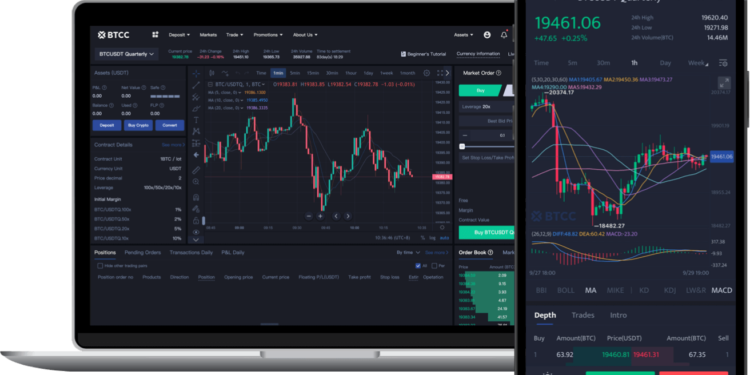

To get started with margin trading, you’ll need to choose a cryptocurrency exchange that offers margin trading. Some popular exchanges include Binance, BitMEX, and Kraken. Once you’ve selected an exchange, you’ll need to create an account and verify your identity. Depending on the exchange, you may need to deposit funds to your account before you can begin margin trading.

After you’ve funded your account, you can begin placing margin trades. Margin trading involves using leverage, which means borrowing funds to increase your buying power. For example, if you have 1 BTC and you want to make a margin trade with 10x leverage, you can borrow 9 BTC to increase your buying power to 10 BTC. However, keep in mind that leverage amplifies gains and losses, so it’s important to use it judiciously.

Common Margin Trading Strategies

There are several common margin trading strategies that traders use to generate profits. These include:

- Long or Short Position: Traders can take a long position by buying BTC/USDT or Ethereum with the expectation that the price will rise. Conversely, traders can take a short position by selling BTC/USDT or Ethereum with the expectation that the price will fall.

- Scalping: Scalping is a short-term trading strategy that involves making quick trades to capture small profits. Traders who use this strategy aim to make many small trades throughout the day.

- Swing Trading: Swing trading is a medium-term trading strategy that involves holding positions for several days or weeks. Traders who use this strategy aim to capture larger price movements.

Risk Management in Margin Trading

Margin trading can be a high-risk strategy, so it’s important to manage your risk carefully. Here are some tips for managing risk in margin trading:

- Set Stop-Loss Orders: Stop-loss orders are automatic orders that sell your assets if the price falls below a certain level. Setting stop-loss orders can help you limit your losses if the market moves against you.

- Use Proper Leverage: Using too much leverage can amplify your losses, so it’s important to use leverage judiciously. As a beginner, it’s generally recommended to start with lower leverage until you become more familiar with the risks involved.

- Diversify Your Portfolio: Diversifying your portfolio can help you spread your risk across different assets. This can help mitigate your losses if one asset performs poorly.

Final Words

Margin trading can be a high-risk, high-reward strategy for investing in cryptocurrencies like BTC/USDT and Ethereum. To get started with margin trading, you’ll need to choose an exchange that offers margin trading and create an account. Common margin trading strategies include long or short positions, scalping, and swing trading. It’s important to manage your risk carefully by setting stop-loss orders, using proper leverage, and diversifying your portfolio.